Fraud cases have witnessed a sharp uptick, a 60.1% increase since 2018. This surge could be attributed to evolving technological methods, economic fluctuations, or enhanced detection mechanisms.[1]

Contrary to popular belief, fraudsters present a diverse demographic, challenging established stereotypes. This diversity underscores the unpredictability of fraud based on profiling alone.

The median financial loss due to fraud stands at a staggering $142,487. This figure not only indicates the prevalence of small-scale frauds but also highlights instances where substantial sums are involved, causing significant financial distress to victims.

The average incarceration duration for fraud-related convictions is 19 months. The intricacies of fraud prosecution, plea bargains, jurisdictional variations, or the prioritization of other crimes in the legal system might influence this relatively brief sentence duration.

Florida and Pennsylvania emerged as the leading states for fraud occurrences. Factors such as population density, specific economic conditions, regulatory landscapes, and targeted demographics (e.g., Florida's sizable elderly population) might contribute to this prominence.

The integrity of government systems, especially those dealing with financial assistance, is crucial for maintaining public trust and ensuring that aid reaches those who truly need it. However, the U.S. Sentencing Commission's FY 2022 report.[1] unveils a troubling trend: a 60.1% spike in government benefits fraud since FY 2018.

This significant jump represents substantial financial losses and highlights potential vulnerabilities in the system. This article offers an in-depth analysis of this phenomenon, examining the data, exploring the societal implications, and considering potential preventative strategies.

Fast Facts

60.1% Rise in Government Benefits Fraud could be attributed to evolving technological methods, economic fluctuations, or enhanced detection mechanisms

Who Are the Offenders?

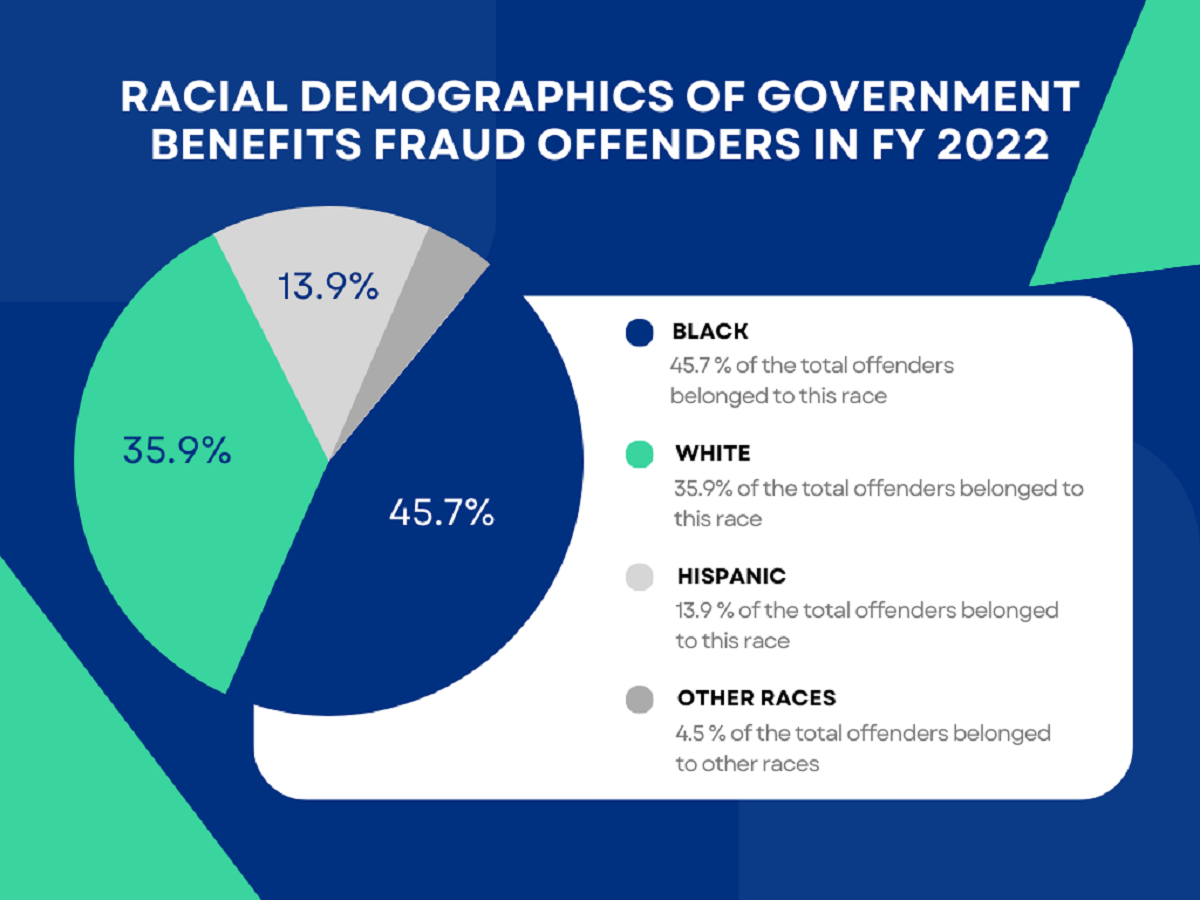

Understanding the profile of the typical offender is crucial in combatting government benefits fraud. The FY 2022 report sheds light on various demographic aspects:

Fast Facts

61.2% of offenders were men, highlighting a gender difference in the commission of these crimes.

- Gender Disparity: Most offenders were men (61.2%), indicating a gender disparity in committing these crimes.

- Diverse Racial Backgrounds: Offenders represented diverse racial backgrounds, with 45.7% being Black, 35.9% White, 13.9% Hispanic, and 4.5% from other racial groups. This diversity suggests that government benefits fraud transcends racial boundaries and that a one-size-fits-all prevention approach may be ineffective.

- Middle-aged Predominance: The average age of the offenders was 43, which might reflect a degree of financial pressure or criminal opportunism commonly experienced in middle age.

- Citizenship Status: The overwhelming majority (90.1%) were U.S. citizens, implicating native-born individuals more than immigrants in these schemes.

- Lack of Prior Criminal History: Interestingly, 64.9% had little or no criminal history, challenging the stereotype that those with extensive criminal backgrounds typically commit such fraud.

The data suggests that the typical offender cannot be easily pigeonholed; they come from various backgrounds and demographic categories.

Median loss of $142,487: Dissecting the Offenses

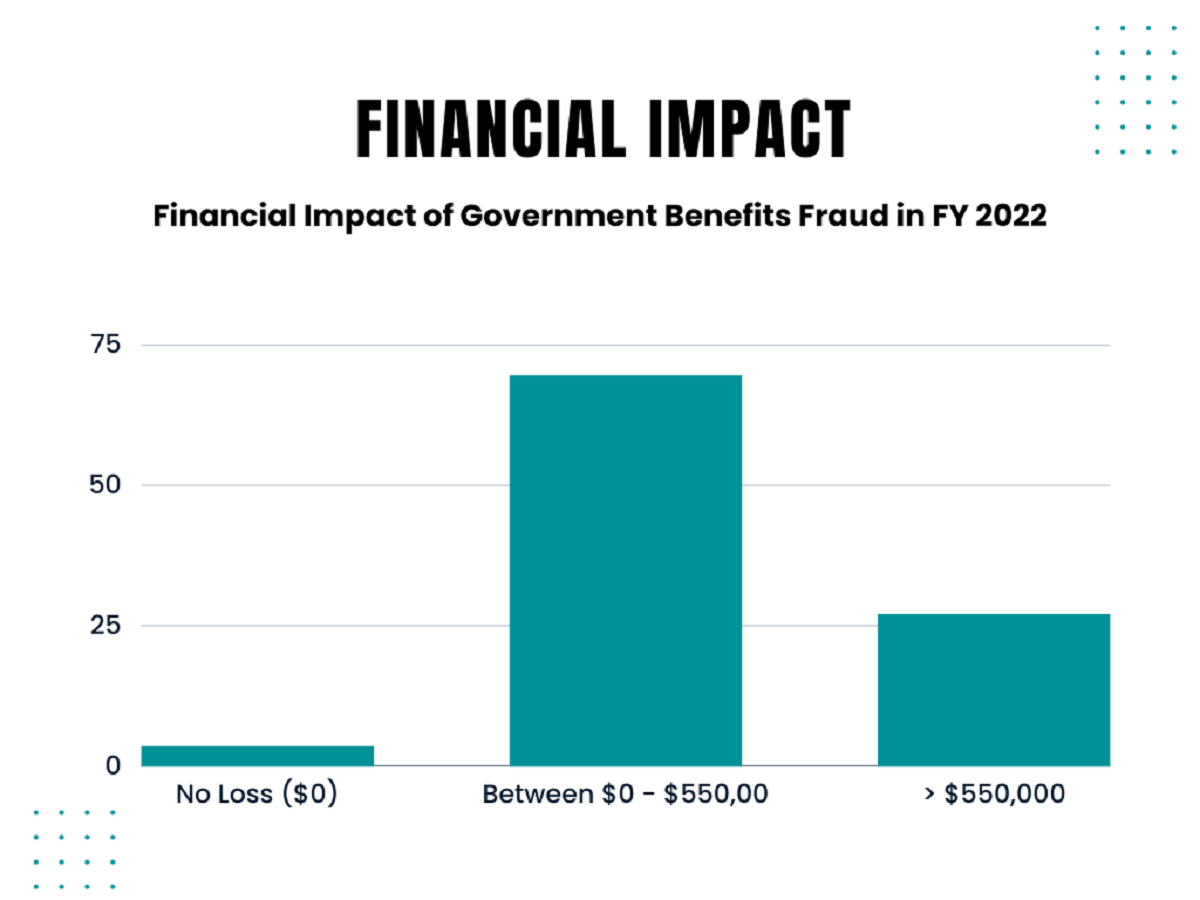

The financial impact of government benefits fraud is staggering, with the median loss in these cases being $142,487. The report further breaks down the losses:

Fast Facts

27.0% of the offenses involved loss amounts greater than $550,000

- No Loss in Some Cases: In 3.5% of the cases, the loss amount was $0, possibly indicating attempted fraud that was intercepted before funds were stolen.

- High-Loss Cases: A significant 27.0% of the offenses involved loss amounts greater than $550,000, highlighting the presence of high-stakes fraud that drains substantial resources from government coffers.

These figures underscore the financial incentive behind these crimes, with offenders potentially walking away with hundreds of thousands of dollars. The high-loss cases, in particular, suggest organized, sophisticated operations that successfully pilfer large sums.

The Sentencing Quandary

Sentencing for government benefits fraud reflects the legal system's attempt to balance punishment with rehabilitation. Several factors influenced sentence lengths:

Fast Facts

Average sentence was 19 month with 73.4% of offenders receiving prison time

- Victim Count and Harm Extent: Sentences were increased in 10.8% of cases due to the number of victims or the extent of harm, recognizing the widespread impact of these crimes.

- The sophistication of Means: 9.4% received longer sentences due to sophisticated means, pointing to the complex nature of some of these fraud schemes.

- Unauthorized Identification Use: In 15.2% of cases, sentences were increased due to unauthorized means of identification, underscoring identity theft's role in these crimes.

The average sentence was 19 months[2], with 73.4% of offenders receiving prison time. This reflects the seriousness with which the justice system views government benefits fraud, particularly given the substantial financial losses and broad societal impact.

Comparative Analysis from 2018 to 2022: 60.15% Surge

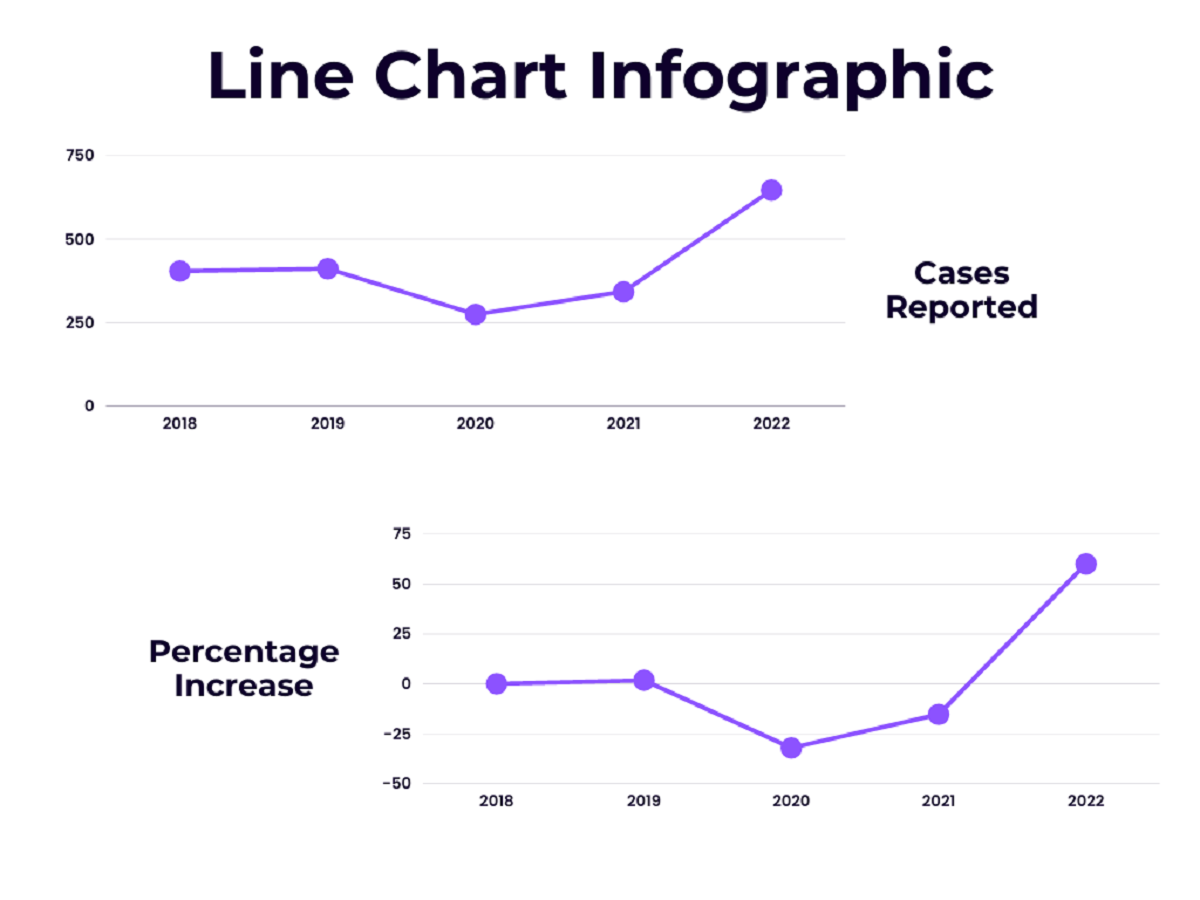

In the realm of government benefits fraud, the years stretching from 2018 to 2022 have been nothing short of a statistical whirlwind.

Fast Facts

A staggering rebound to 647 cases, marking a 60.15% surge compared to 2018

- Starting from a baseline of 404 cases in 2018, the fraud landscape underwent significant fluctuations.

- The modest rise of 1.73% in 2019 barely hinted at the volatility ahead.

- Come 2020, cases plummeted by 32.18%, a decline potentially spurred by global upheavals and unprecedented shifts in regulatory oversight amidst the pandemic. However, the respite was short-lived.

- By 2021, the tide began to turn, albeit cases were still down by 15.35% from the 2018 figures. [3]

- The real shocker unfurled in 2022, with a staggering rebound to 647 cases, marking a 60.15% surge compared to 2018.

This tumultuous journey underscores a critical lesson: the battle against fraud is far from static. It's a pulsating saga marked by wins and setbacks, demanding unwavering vigilance, agile policies, and a refusal to rest on temporary laurels. This section is a stark reminder that in the fight against fraud, past patterns are not definitive forecasts, and proactive adaptation is the only way forward.

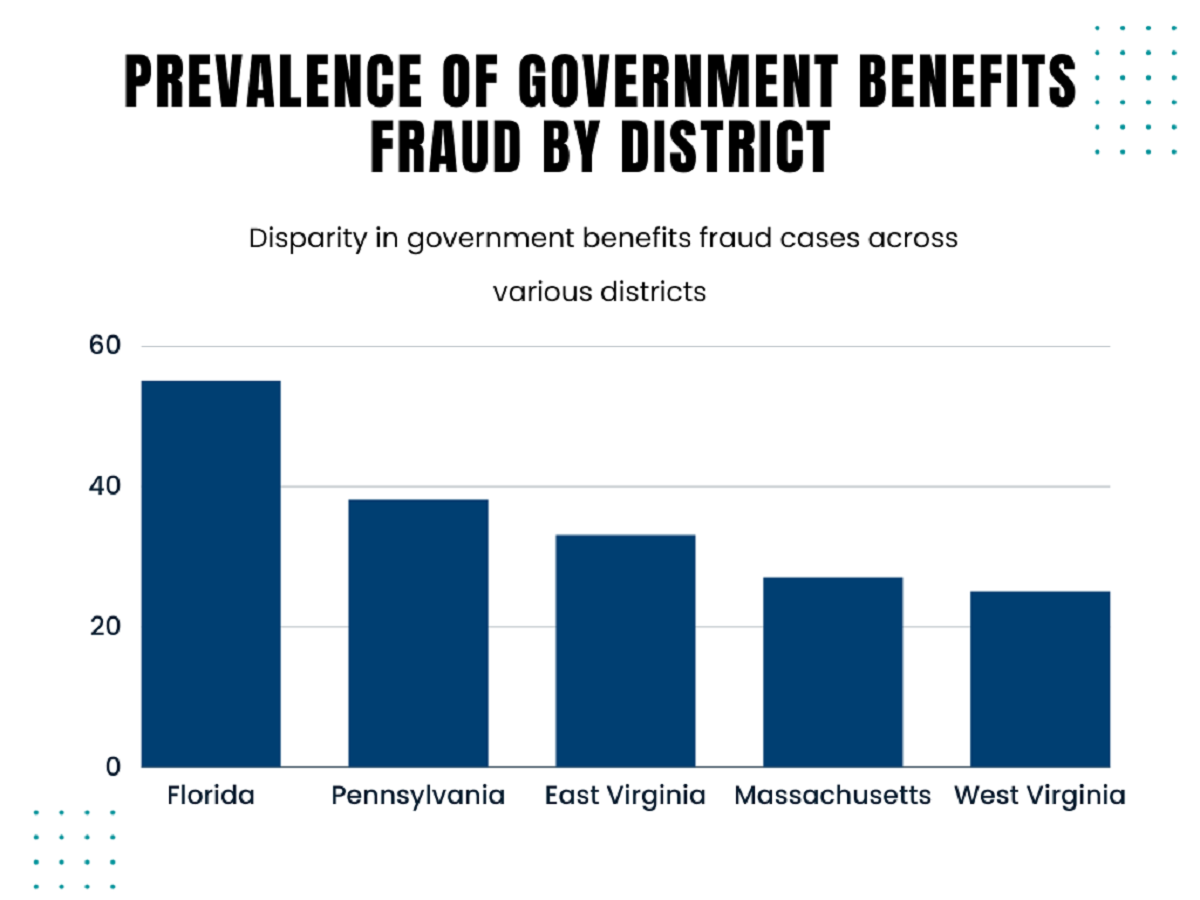

Geographic Concentrations: Florida takes the lead

Fraudulent activities are unevenly spread nationwide; certain districts have emerged as hotspots. The top districts for government benefits fraud include:

Fast Facts

Leading the list with 55 cases, Florida high numbers could be influenced by its large population

- Southern District of Florida: Leading the list with 55 cases, this district's high numbers could be influenced by its large population, demographic factors, or specific local vulnerabilities in the benefits system.

- Western District of Pennsylvania: Following 38 cases, the reasons might be similar to Florida, warranting detailed local investigations to determine causative factors.

- Eastern District of Virginia: With 33 cases, the proximity to the nation's capital and numerous government institutions might impact the fraud rate.

- District of Massachusetts and Western District of Virginia: Reporting 27 and 25 cases, respectively, these areas complete the top five, indicating that government benefits fraud is not confined to any region.

Understanding why these areas are hotspots requires a granular, localized approach considering demographic, economic, and institutional factors.

Societal Implications: Beyond the Financial Losses

The ramifications of government benefits fraud extend far beyond financial metrics. Key implications include:

Fast Facts

Large-scale fraud can have macroeconomic effects, including skewing data for policy decisions

- Eroding Public Trust: When individuals defraud government programs, it undermines confidence in governmental effectiveness and can generate skepticism about the legitimacy of welfare systems.

- Unfair Resource Distribution: Fraudulent claims divert resources from legitimate recipients, potentially leaving vulnerable populations without critical support.

- Economic Ripple Effects: Large-scale fraud can have macroeconomic effects, including skewing data for policy decisions and indirectly impacting the job market and economic growth.

Given these broad societal impacts, combating government benefits fraud is not just a matter of law enforcement but a wider societal concern requiring multi-faceted solutions.

Future-Proofing Systems: Strategies for Prevention

Preventing future fraud is a complex challenge requiring multi-pronged strategies:

- Enhanced Verification Processes: Implementing more rigorous identity verification and eligibility can help prevent fraud at the entry point.

- Advanced Data Analytics: Using data analytics to identify patterns and anomalies can flag potential fraud cases for further investigation.

- Inter-Agency Collaboration: Different government agencies must collaborate, sharing data and intelligence to identify and combat sophisticated fraud rings.

- Public Awareness Campaigns: Educating the public about the nature of these crimes and how to report suspicious activities[4] can turn everyday citizens into a powerful first line of defense.

- Continuous Policy Evaluation: Policies and protocols should be regularly reviewed and updated to address emerging fraud tactics and technological advancements.

A Call for Vigilance and Action

The 60.1% surge in government benefits fraud since FY 2018 is a wake-up call. While the U.S. Sentencing Commission's report provides invaluable insights, it's also a stark reminder of the continuous evolution of fraud. Combating this issue requires robust law enforcement, systemic changes, technological advancements, and public engagement.

As we forge ahead, it's imperative to remember that the fight against government benefits fraud is about recovering losses and upholding the integrity of systems designed to aid the nation's most vulnerable. It's about restoring trust in public institutions and ensuring that assistance reaches those who genuinely need it. Awareness, innovation, and collaboration will be our most potent weapons in this ongoing battle.

Are you looking for the best places that accept Electronic Benefits Transfer (EBT)? Learn more about your options from our trusted resources at Gov Relations.

Do you find this article insightful and relevant to your audience? We've poured our expertise and rigorous research into crafting this piece. We're just a message away if you want to link to our article! Reach out to us through our contact form, and let's discuss how we can collaboratively contribute to an informed and engaged readership.

- United States Sentencing Commission. Government Benefits Fraud: Fiscal Year 2022 Quick Facts. United States Sentencing Commission, www.ussc.gov/sites/default/files/pdf/research-and-publications/quick-facts/Government_Benefits_Fraud_FY22.pdf.

- United States Sentencing Commission. Government Benefits Fraud: Fiscal Year 2022 Quick Facts. United States Sentencing Commission, 2023, www.ussc.gov/sites/default/files/pdf/research-and-publications/quick-facts/Government_Benefits_Fraud_FY22.pdf.

- United States Sentencing Commission. Government Benefits Fraud: Fiscal Year 2021 Quick Facts. United States Sentencing Commission, 2022, www.ussc.gov/sites/default/files/pdf/research-and-publications/quick-facts/Government_Benefits_Fraud_FY21.pdf.

- "Where to Report Scams." USA.gov, 15 June 2023, www.usa.gov/where-report-scams.